It is very necessary to understand the tax slab for the year 2023-24 to calculate your income tax. What is the tax slab for the years 2023 and 2024? All the tax rates are equal for females and males. what is the fundamental exemption of income tax in India? other similar questions can be addressed in this article.

Income Tax Slab 2023-24

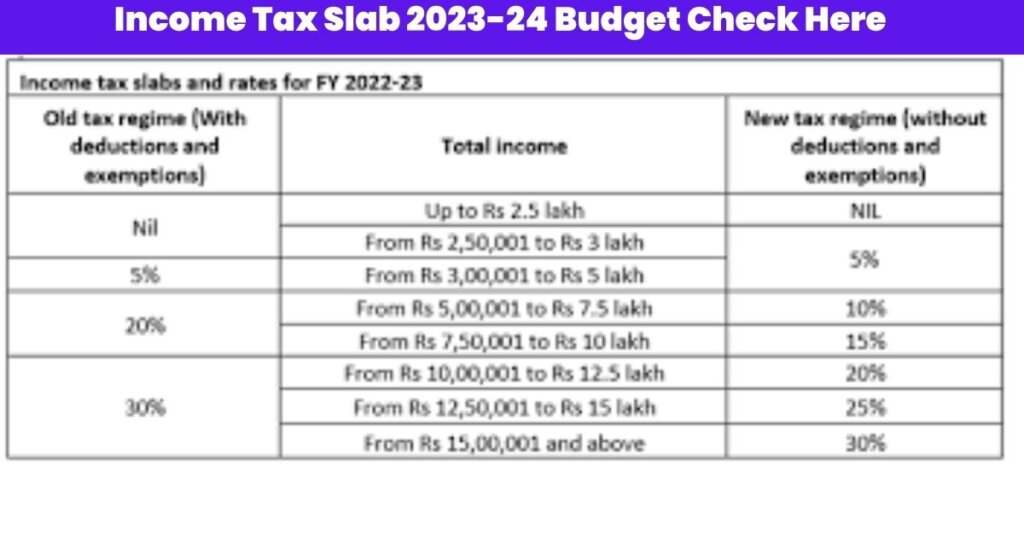

Income Tax Slab 2023-24: The calculation of income tax in India is dependent on the income tax slabs and rates applicable to the fiscal year calendar (FY) and the assessment years (AY). Tax slabs on income for FY 2023-24 have been announced in the Union Budget 2023-24.

In this article, we will look at the rates of income tax slabs in the fiscal year 2023-24 (AY 2023-24) we should first have a look at the definition of what the income tax slab actually is as well as the various types of tax-deductible income that are tax-deductible in India and the main differences between the current tax system and the previous one.

- Income Tax Latest Update 2023: टैक्स में जा रहा है अगर मोटा पैसा तो तुरंत कर लें उपाय, ये 9 स्कीम बचा सकती है आपका रुपया

- Expectations from last year’s whole Union Budget of Modi 2.0 government

- ITR Rules 2023: अगर नाबालिग करे कमाई तो क्या उसके पिता को देना होगा टैक्स? समझें कानून की बारीकियां

Types of Tax Slabs in India

Individual taxpayers in India are required to pay tax on income through the slab system. The term slab-based system is a system where different tax rates are imposed for various income levels. This means that tax rates will continue to rise when the income of the taxpayer increases. This tax system lets the country enjoy an equitable and progressive tax system. These income tax slabs can be changed in every budget. The rates for these slabs differ for different taxpayer types.

Tax on income has three types that are “individual” taxpayers, which include:

- People (aged under 60) comprising residents and non-residents.

- Residents Senior Citizens (60 up to 80 old)

- Senior citizens who are Resident Super Senior (aged over 80 years old)

What is Income Tax?

Income Tax is assessed on an individual’s net income taxable during the fiscal year which begins on April 1 and concludes on March 31 of the next year. It is calculated based on an individual’s, or a company’s net tax-deductible income. In India, the Government of India has set certain slab rates, i.e., higher and lower slab rates to facilitate the lives of its citizens.

The rates for Income Tax Slabs were announced by the Union Budget 2023-24

The tax-free personal income limit has been increased to Rs 7. lakh from the earlier limit of Rs 5 lakh under the new tax system. Individuals earning up to 7 lacks do not pay income tax.

Finance Minister Nirmala Sitharaman said “I introduced in 2020, the new personal income tax regime with 6 income slabs, starting from Rs 2.5 Lakhs. I propose to change the tax structure in this regime by reducing the number of slabs to 5 and increasing the tax exemption limit to Rs 3 Lakhs”.

A person earning a salary of more than 15 lakhs would be required to pay 1.5 lakhs tax, which is down from 1.87 lakhs in the tax system.

| Annual Income | New Tax Regime |

| Zero-3 lakhs | 0% |

| 3 to 6 lakhs | 5% |

| 6-9 lakhs | 10% |

| 9-12 lakhs | 15% |

| 12-15 lakhs | 20% |

| More than 15 lakhs | 30% |

The Finance Minister also cut the most expensive surcharge for India to 25% instead of the current 37%.

Direct tax propositions:

- The processing time of ITRs has been decreased from 93 days to 16 days

- The government plans to release next-generation IT Return forms that are common IT Return forms as well as enhance the grievance redressal system

Previous Income Tax Slab rates

The prior income tax slabs under the regular tax regime included:

- Up to Rs . 2,50,000 earnings – Tax-free

- Rs 2,50,001 to Rs 5,00,000 in the Income Tax rate of 5% rate

- 50,00,001 Rs 10,00,000. Tax Rate: 20% rate

- Above Rs 10,00,000. Tax rate of 30% rate

Income Tax Slab Rates AY 2023-24 for Individuals Below 60 Years, NRIs and HUFs

Now let’s examine how income tax rates will be assessed for the FY 2023-24 (AY 2023-24) in the tax regimes of resident individuals who are less than 60, Hindu Undivided Family (HUF), and Non-Resident Indians (NRI) who earn in India:

New Tax Regime Slab Rates

| Income Tax Slabs | Old Tax Regime Income Tax Slab Rates FY 2023-24 | New Tax Rates for Ages below 60 Years |

|---|---|---|

| Rs, 0 – Rs. 2,50,000 | Exempt | 0% |

| Rs. 2,50,000 – Rs. 5,00,000 | 5% | 5% |

| Rs. 5,00,000 – Rs. 7,50,000 | 20% | 10% |

| Rs. 7,50,000 – Rs. 10,00,000 | 20% | 15% |

| Rs. 10,00,000 – Rs. 12,50,000 | 20% | 20% |

| Rs. 12,50,000 – Rs. 15,00,000 | 30% | 25% |

| More than Rs. 15,00,000 | 30% | 30% |

Income Tax Slabs FY 2023-24 (AY 2023-24) for Senior Citizen Taxpayers

In India, Senior Citizen taxpayers are people who are 60 but less than the age of 80. They benefit from a higher standard exemption limit. 3 lakh than people who are less than 60 years old under the previous tax system. But, this benefit of higher exemptions isn’t offered to seniors who are taxpayers and opting to take advantage of the new tax system. Below is a table that summarizes the income tax slab rates for the AY 2023-24 (FY 2023-24) for seniors in India:

Old Tax Regime Slab Rates

| Income Tax Slabs | Old Tax Rates for Senior Citizens |

|---|---|

| Rs, 0 – Rs. 3,00,000 | 0% |

| Rs. 3,00,000 – Rs. 5,00,000 | 5% |

| Rs. 5,00,000 – Rs. 10,00,000 | 20% |

| More than Rs. 10,00,000 | 30% |

New Tax Regime Slab Rates

| Income Tax Slabs | New Tax Rates for Senior Citizens |

|---|---|

| Rs, 0 – Rs. 2,50,000 | 0% |

| Rs. 2,50,000 – Rs. 5,00,000 | 5% |

| Rs. 5,00,000 – Rs. 7,50,000 | 10% |

| Rs. 7,50,000 – Rs. 10,00,000 | 15% |

| Rs. 10,00,000 – Rs. 12,50,000 | 20% |

| Rs. 12,50,000 – Rs. 15,00,000 | 25% |

| More than Rs. 15,00,000 | 30% |

Income Tax Slabs in AY 2023-24 (FY 2023-24) for Super Senior Citizens

According to the current tax laws, the super senior citizens are those who are over 80. In the tax system of the past Super senior citizens had the benefit of a higher exemption limit of 5 lakh rupees. 5 lakh, as per the taxes on income for the fiscal year 2023-24. However, this benefit isn’t available under the tax reforms of 2023-24, even when those slab rate rates in AY 2023-24 are lower when compared to the previous tax system. The table below provides a summary of the tax rate for income as well as rates that apply to super senior citizens for FY 2023-24.

Old Tax Regime Slab Rates

| Income Tax Slabs | Old Tax Rates for Super Senior Citizens |

|---|---|

| Rs, 0 – Rs. 5,00,000 | 0% |

| Rs. 5,00,000 – Rs. 10,00,000 | 20% |

| More than Rs. 10,00,000 | 30% |

New Tax Regime Slab Rates

| Income Tax Slabs | New Tax Rates for Super Senior Citizens |

|---|---|

| Rs, 0 – Rs. 2,50,000 | 0% |

| Rs. 2,50,000 – Rs. 5,00,000 | 5% |

| Rs. 5,00,000 – Rs. 7,50,000 | 10% |

| Rs. 7,50,000 – Rs. 10,00,000 | 15% |

| Rs. 10,00,000 – Rs. 12,50,000 | 20% |

| Rs. 12,50,000 – Rs. 15,00,000 | 25% |

| More than Rs. 15,00,000 | 30% |

Beyond the tax obligation for income determined by the Income Tax slab rate for the fiscal year 2023-24, you are also required to pay an additional 4 per cent health and education tax as part of your total tax bill in the current fiscal.

What is Income Tax Slab?

Income tax is the tax you have to pay on your income in an accounting year. In India the income tax rate is progressive i.e. If you earn less you pay less tax, and if you earn a high amount of tax, you pay at an increased rate.

To determine the amount of income tax that must be paid to be paid, the Government of India has introduced income tax slabs and rates. Income tax is a slab that identifies the range of tax rates within which a set rate of taxation applies. Based on the tax slab that a person is in, the relevant tax rate for income is determined that is used to calculate the tax liability for income. tax obligation for the particular fiscal.

At present, Indian taxpayers are able to choose between two tax regimes: the old tax system as well as the tax reform. The income tax rates and slabs in the FY of 2023-24 (AY 2023-24) differ based on whether the taxpayer is using the old or the new tax regime for calculating tax liabilities for the fiscal.

Types of Taxable Income in India

Tax on income is applicable to a variety of types of taxpayers such as trusts, individuals, corporations, etc. So, there are many sources of income that could be taxed in India. Here are the diverse types of tax-paying income in India in accordance with the Income Tax Act, of 1961:

* Salary income or pension

In this class, taxes usually apply to the salary base allowances, profits, and the base salary earned by the income. Pensions earned by a person after retirement is taxed in accordance with the tax rate of income. The tax rates of the income tax slab FY 2023-24 (AY 2023-24) differ depending on age an individual who earns pension or salary in the period of.

* Earnings from business

Profits from business are also considered income tax deductible. The tax for this category is determined by the income that is presumptively or actually from the business or profession could earn. But, it’s only made after adjustments to allowable deductions are done. In FY 2023-24, various rates will be applicable to the individual income and corporations. While corporations are taxed as corporations however, those earning business earnings will be taxed in income tax slabs as well as rates for FY 2023-23.

* Earnings earned from House Property

owning more than one property and then letting them go for rental is an easy method to earn extra money. In such instances the rental income of house properties is considered as a part of the taxpayer’s earnings. Therefore, this income is tax deductible in accordance with the tax slab rates for income for FY 2023-24.

* Earnings comes from Winning Lottery, Horse Races, etc.

The earnings from other sources like winning lotterytickets, horse races. These are tax-deductible in India. However, according to the current taxes, the gains are taxed as a separate item and not subject to the rate slabs for income taxes for FY 2023-24.

* Earnings derived from Capital Gains

Capital Gains Income can be made from the sale items like gold or home property, mutual fund units and stocks, debentures, etc. The type of asset as well as the earnings earned over the course of time, it is classified as a short-term or long-term capital gain. Although these earnings are a part of income tax system the capital gains tax rules for 2023-24 are separate of the tax slabs on income for the year 2023-24.

Key Differences Between New & Old Tax Regimes

The fiscal year 2020-21 saw a brand new tax system introduced in addition to the old tax system. For the fiscal year 2023-24 (AY 2023-24) taxpayers are able to select one of these tax regimes and pay taxes in accordance with the tax regime they choose. There are two major differences between the two tax systems for income for India.

- First of all, the new tax regime has more tax slabs and lower tax rates when opposed to the tax system. Thus, the tax rates for FY 2023-24 (AY 2023-24) are different depending on whether you choose the new or older tax system.

- The second reason is that all of the major deductions and exemptions like Section 80C and Section 80D and Section 80D. that were available under the previous tax regime cannot be claimed when you choose to use the new tax system.

Tax deductions and exemptions enable taxpayers to lower their tax burden by investing in, saving for, or investing in certain financial instruments. The new tax law gives the taxpayer a limited number of exemption or deduction choices, even when the tax slab rates for income applicable to AY 2023-24 are lower in comparison to the previous tax regime. The old tax system allowed the possibility of up to 70% exemptions or deductions to reduce your tax-deductible income and tax obligation during FY 2023-24.

Surcharge on Income Tax in AY 2023-24

Taxpayers who fall into the high-income bracket who have taxable net incomes of more than 50 lakhs in the assessment of the year 2023-24 i.e. the financial year 2023-24 have the obligation to make a charge of their tax on income using the slab rates for income tax in FY 2023-24. The surcharge rate applicable is according to the following for FY 2023-24.

| Annual Income | New Tax Regime |

| 0-3 lakhs | 0% |

| 3-6 lakhs | 5% |

| 6-9 lakhs | 10% |

| 9-12 lakhs | 15% |

| 12-15 lakhs | 20% |

| Above 15 lakhs | 30% |

Things to Keep in Mind Before Opting for the New Tax Slab

The option of choosing between the new tax regime or the previous tax regime is currently available to individual taxpayers in India. However, before making your decision there are five important items to remember:

* Consider Tax Saving Deductions and Exemptions

In FY 2023-24 the new tax regime offers lower tax slab rates for income and more income tax slabs as compared to the previous regime. The new tax regime provides a limited number of deductions and exemptions. This includes about 70 deductions, exemptions like HRA and Section 80C deductions as well as home loan interest benefits that are eligible under the tax system of the past but not under the new system.

* Lower Tax Exemption Limit Based on Age

The tax system of the past provides an exemption from tax for seniors and super senior citizens . 3 lakh and Rs. 3 lakh and 3 lakh and Rs. 5 lakh, respectively, in accordance with the income tax slab rates for AY 2023-24. The higher amount is not applicable under the current tax system, which provides the identical limit of Rs. 2.5 lakh exemption amount, regardless of age.

* Consider Benefits Beyond Tax Savings

Investments that reduce tax and costs such as expenses like a time-based life insurance plan, Public Provident Fund, National Pension System have a double advantage under the tax system that was in place prior to the current one. On one hand you reduce the amount of tax you pay, but however, they provide other benefits, such as the security of your loved ones’ finances or the creation of wealth over the long term. With the new tax law you don’t get the tax-saving benefit in any way.

The tax advantages for these types of investments is restricted by the amount of Rs. 2 lakh over the course of a fiscal after adding the amount of Rs. 50k benefit provided under the 80 CCD (1B). Therefore, you must make use of an income tax calculator to calculate the tax burden under the old and the new regime to determine the one that is most suitable for you based on rate of income tax for the FY 2023-24.

FAQs

Do I need to select one of the tax reforms as well as relevant Income Tax Slabs to be used for the AY 2023-24?

No. As a taxpayer, you are able to decide to go with the new or old tax system, and pay taxes according to the slab rates of income tax during the fiscal year 2023-24 i.e. AY 2023-24.

Do I have to file my Income Tax Return (ITR) If my annual income is less than the amount of 2.5 lacks?

It is compulsory to complete your ITR only when your annual earnings exceed the maximum amount exempted of 2.5 lacks. 2.5 lakh.

Are the income tax brackets applicable to AY 2023-24 under the context of the new tax system identical to all taxpayers regardless of their age?

Yes, the taxes on income applicable to AY 2023-24 (FY 2023-24) under the new tax system do not change with respect to how old the taxpayer is. The limit for the maximum tax-exempt amount is 2.5 lakh, regardless of the taxpayer’s age.

Are you eligible for the standard deduction on your salary of Rs. 50,000 under the tax reform system?

The deduction standard of Rs. 50k per year on salary can’t take advantage of the current tax system. It is necessary to choose the old tax system in order to benefit from this tax benefit.

Are there any adjustments to in the tax rate for income for FY 2023-24 within the most recent budget?

Income slab rates in FY 2023-24 (AY 2023-24) are in the process of being the same as slab rates for FY 2023-24.

Source:

https://cleartax.in/s/income-tax-slabs

https://www.creditmantri.com/article-what-types-of-incomes-are-taxable-in-india/

https://www.livemint.com/money/new-income-tax-regime-vs-old-income-tax-regime-what-should-you-opt-for-in-2022-11644713424562.html

https://www.taxmann.com/post/blog/income-tax-slab-rates/

https://www.incometaxindia.gov.in/_layouts/15/dit/mobile/viewer.aspx?path=https://www.incometaxindia.gov.in/charts++tables/tax+rates.htm&k&IsDlg=0

https://www.valueresearchonline.com/stories/47951/choosing-between-the-old-and-new-tax-slabs/